“Why are we still chasing invoices manually in 2025?”

That’s a question many finance leaders are asking themselves. Every month, your team sifts through piles of invoices, matching line items to purchase orders, checking for duplicate entries, correcting vendor names, and resolving exceptions. And even the most experienced accounts payable teams get overwhelmed. One missed decimal point or one duplicate payment could cost you thousands.

Now, imagine a world where invoice validation happens automatically. No back-and-forth. No errors. No late payments. Just clean, validated invoices flowing directly into your accounting system, ready for approval. That’s not a dream. It’s what automated invoice validation is designed to do, and it directly boosts your company’s profitability.

Why do Manual Invoice Validation Processes Hurt Profitability?

Manual invoice validation is slow, expensive, and prone to mistakes. Whether you’re verifying invoices against purchase orders, job references, or internal approval chains, the process involves a lot of repetitive tasks, data entry, field checking, and reconciliation. These steps, when handled manually, cost both time and money.

Here are some of the hidden costs tied to manual validation:

- Overpayments due to incorrect or duplicate invoices

- Late fees from missed approvals or forgotten due dates

- Vendor disputes from unmatched line items or missing PO numbers

- Labor costs tied to low-value data entry work

- Errors that affect the month-end close and audit readiness

Even small mistakes compound over time. If you’re processing hundreds or thousands of invoices per month, the inefficiencies add up, and that directly eats into your profit margins.

How does Automated Invoice Validation Work?

Automated invoice validation is the process of using AI, OCR (optical character recognition), and business rules to automatically check and verify invoice details before they’re approved or paid. The system reads data from invoices, vendor name, invoice number, line items, amounts, tax codes, and matches them with the corresponding purchase orders, receipts, or system rules.

Here’s what a typical automated flow looks like:

- Invoice Capture: Invoices arrive via email or upload, and the system reads the files instantly.

- Data Extraction: OCR and AI extract key fields like invoice date, vendor name, line items, totals, and tax amounts.

- Validation Rules: The system runs these fields through predefined business rules, checking for duplicates, mismatches, or missing data.

- PO/GRN Matching: It matches invoice data with purchase orders, goods received notes (GRN), or project/job codes in your ERP or accounting system.

- Exception Handling: Any invoice that doesn’t meet the rules is flagged for review. Everything else gets automatically approved and posted.

- Audit Trail: The system keeps a full record for auditing and reporting purposes.

What’s the result? Clean, accurate invoices, without hours of manual work.

How does This Automation Improve Profitability?

Every finance process you automate contributes to cost savings. But invoice validation, in particular, delivers a strong and direct impact on profitability in several ways:

1. Fewer Invoice Errors

When the system validates every field and matches before approval, errors like overcharges, duplicate entries, or mismatched vendor details are caught instantly. That alone can save thousands each month in incorrect payments.

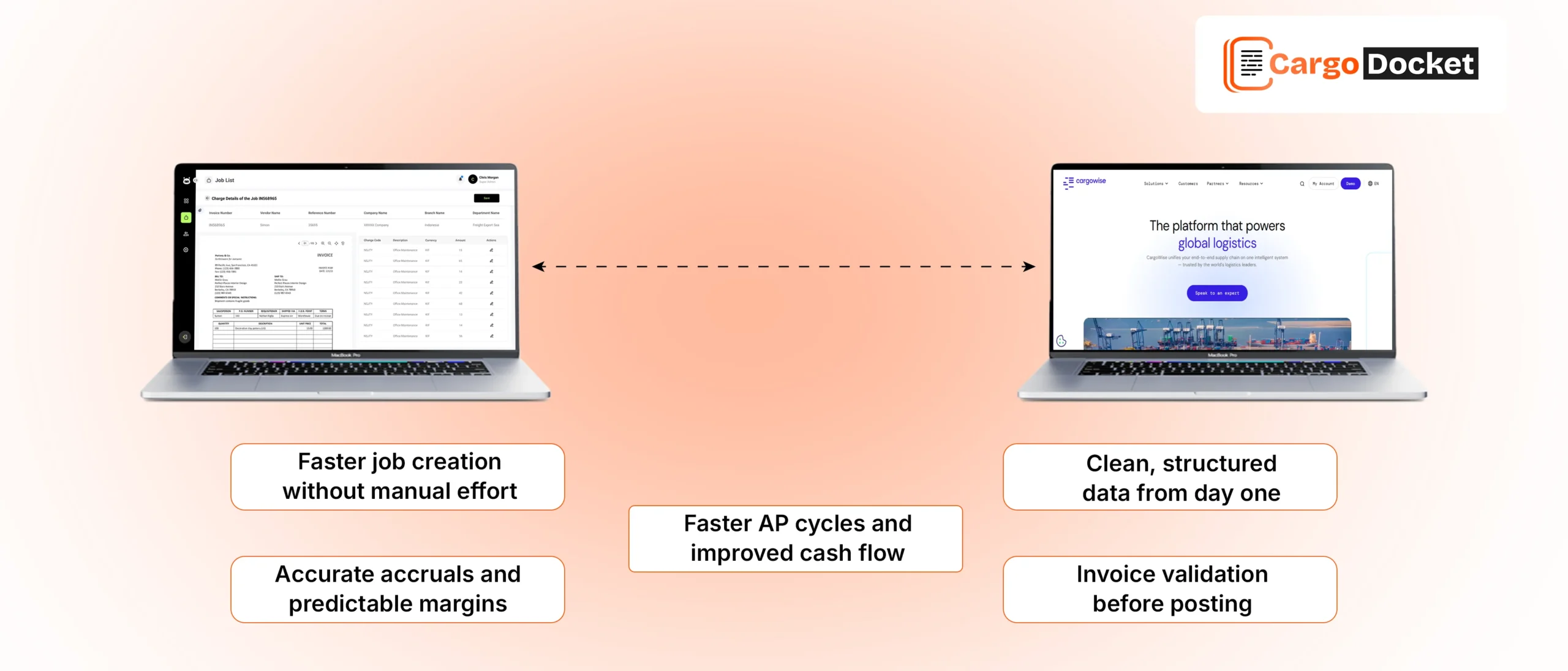

2. Faster Invoice Processing

With automation, your team can process invoices in minutes instead of hours or days. This leads to faster approvals, early payment discounts, and fewer obstacles in your accounts payable cycle.

3. Lower Operational Costs

The average cost of processing an invoice manually is between $7 and $10. With automation, it drops to $2 or less. When you’re handling thousands of invoices, that’s a huge savings opportunity.

4. Stronger Vendor Relationships

Timely, accurate payments keep vendors happy and reduce friction in the supply chain. You’ll also cut down on emails, calls, and reconciliations.

5. Better Visibility into Spend

Automated systems provide real-time dashboards and reports that help you track KPIs like invoice aging, DPO (Days Payable Outstanding), and approval bottlenecks. Better visibility means smarter decisions.

What Steps Should You Take to Implement It?

If you’re considering invoice validation automation, here’s a simple step-by-step approach:

Audit Your Current Process

Document your existing invoice flow. Identify where most errors or delays happen, PO matching, approvals, tax validation, etc.

Clean Your Vendor & PO Data

Automation only works as well as your data. Standardize vendor codes, PO formats, and accounting codes across systems.

Choose the Right Platform

Look for a solution that integrates well with your ERP (like CargoWise), supports OCR, and allows custom validation rules.

Train Your Team

Introduce automation as a time-saver, not a job-replacer. Help your AP team shift focus from data entry to strategic analysis and vendor support.

Track KPIs

Use dashboards to monitor cost per invoice, cycle time, exception rates, and vendor feedback. Use this data to improve continuously.

Conclusion

If your finance team is still bogged down by manual validation, you’re not just losing time, you’re losing money. Automated invoice validation allows you to process invoices faster, more accurately, and with fewer resources. That means more room for growth, fewer costly errors, and a clear path to better profitability.

Want to see how AI document automation can work for your business?

At CargoDocket, we help logistics companies implement end-to-end invoice automation that integrates perfectly with CargoWise and other ERP systems.