Imagine this, you are overwhelmed by piles of purchase orders, invoices, emails, and receipts. Each invoice is being carefully compared line by line with purchase orders and delivery receipts by your staff. In the meantime, suppliers are waiting, deadlines are approaching, and a single mistake might cost your company thousands of dollars. Does that sound familiar?

Introducing the realm of invoice automation, an important yet time-consuming activity. It has historically been an agony of manual labor, numerous Excel sheets, and mistakes that lead to problems with cash flow, vendor disputes, and compliance. Fortunately, artificial intelligence (AI) is stepping in to make this complex, high-stakes procedure quick, precise, and nearly touchless.

What is Invoice Matching, Anyway?

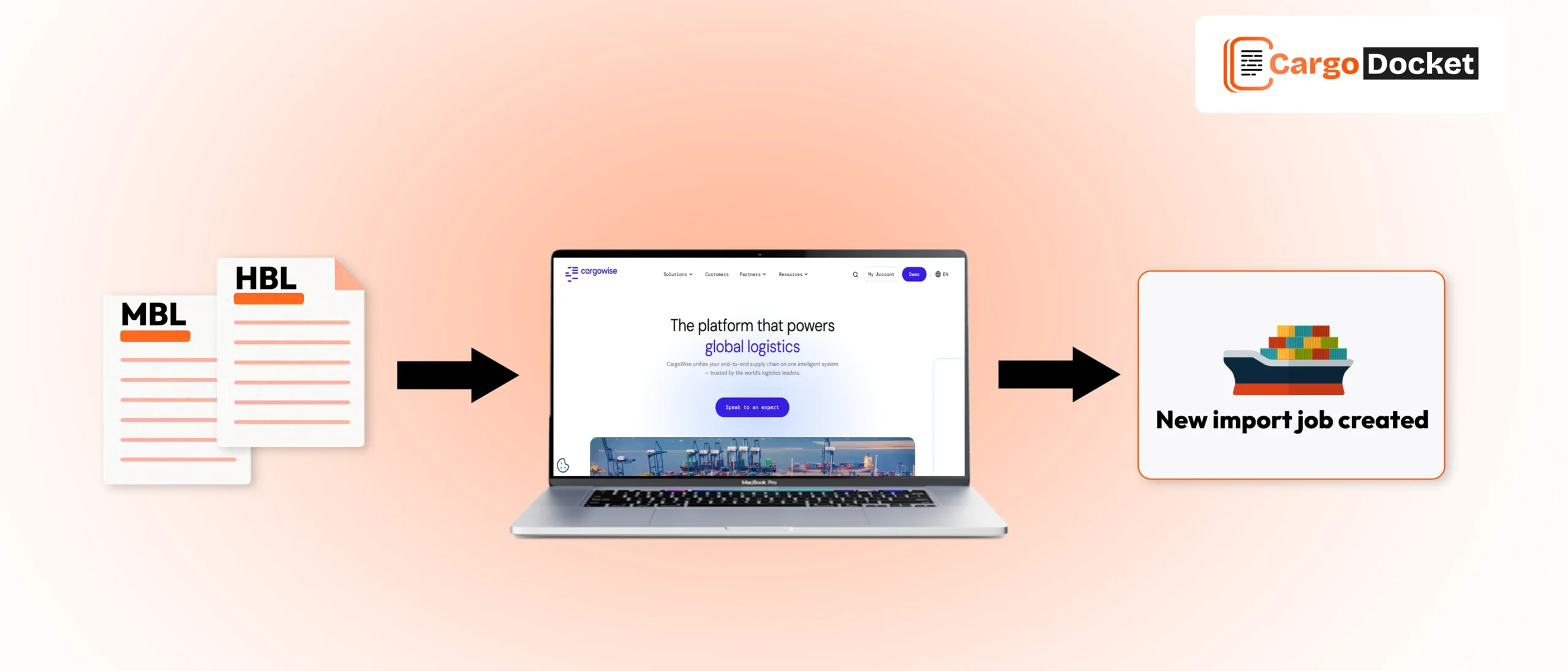

Let’s go back a moment. You must first grasp what invoice matching actually is in order to comprehend AI’s involvement. To put it simply, invoice matching is the process of making sure that incoming invoices match other papers, such as purchase orders (POs) and goods receipts.

Businesses usually practice two-way or three-way matching:

Two-way matching checks the invoice against the PO to confirm quantities, pricing, and terms.

Three-way matching goes a step further by matching the invoice, PO, and receiving report to confirm that goods or services were actually delivered as ordered.

Sounds simple, right? Documents come in different formats. Vendors use different terms. Line items might differ slightly. Humans make mistakes. And that’s where the trouble starts.

Why Manual Invoice Matching Fails?

Even the best accounting teams struggle when matching invoices manually. Here’s why:

- Data Overload: Businesses handle hundreds, even thousands, of invoices each month. Manually matching each document is simply not scalable.

- Error-Prone Processes: Manual entry and visual checks lead to typos, missed discrepancies, and duplicate payments.

- Slow Cycle Times: Invoices linger in queues, delaying payments and causing supplier frustration.

- Higher Costs: The more time spent on invoice matching, the higher the operational costs and the less time teams have for strategic tasks.

- Compliance Risks: Errors in invoice matching can trigger audit issues or regulatory fines.

And the best part is no one wants to waste skilled talent on data entry and detective work when AI can do it better and faster.

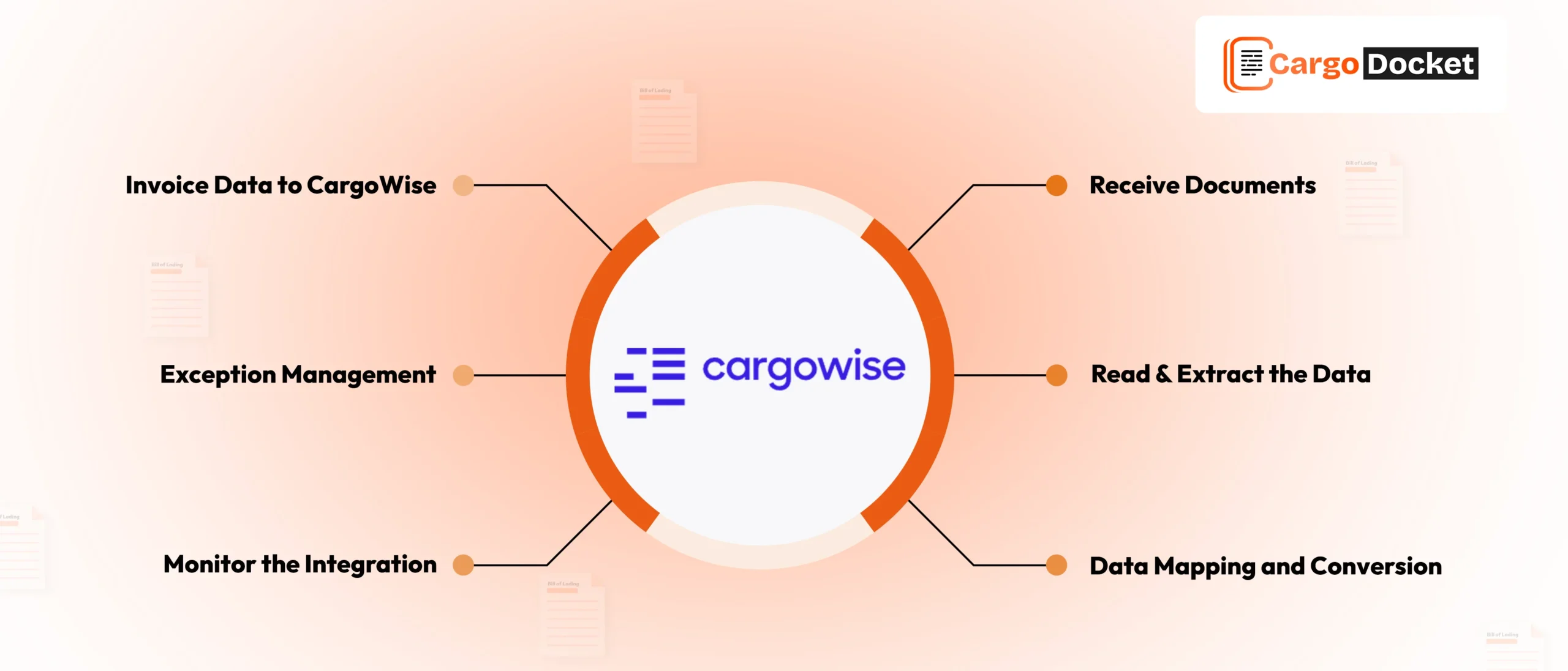

How AI Automation in Invoice Matching Works?

Here’s where AI Automation in Invoice Matching shines. Instead of relying on humans to manually compare documents, AI-powered systems handle the heavy lifting:

- Data Extraction: AI reads invoices using Optical Character Recognition (OCR) and advanced document understanding, extracting key details like invoice numbers, vendor names, amounts, and line items.

- Contextual Understanding: Unlike basic OCR, AI understands context. It knows that “Inv#” and “Invoice No.” mean the same thing, even across different formats and languages.

- Automated Matching: AI automatically matches extracted invoice data against POs, contracts, or delivery receipts in your ERP system. It flags discrepancies like price mismatches, missing goods, or incorrect quantities.

- Exception Handling: Instead of stopping the process for every mismatch, AI prioritizes exceptions and suggests resolutions, saving significant human effort.

- Learning & Adapting: Machine learning models improve over time. They “learn” your vendors’ patterns and adapt to new document layouts, reducing errors and improving accuracy with each transaction.

It’s like having a supercharged team member who never sleeps, never gets distracted, and doesn’t miss a detail.

Top Benefits of AI Automation in Invoice Matching

Still wondering if it’s worth the investment? Here’s why businesses are jumping on the AI bandwagon for invoice matching:

Speed & Efficiency

AI can process invoices in seconds, slashing cycle times from days to hours. Faster processing means quicker payments, fewer late fees, and happier suppliers.

Cost Savings

Reducing manual work translates directly into lower labor costs. Businesses often see ROI within months thanks to significant operational savings.

Error Reduction

AI-driven matching dramatically reduces data entry errors and duplicate payments. Accurate matching ensures your financial records stay clean and audit-ready.

Better Cash Flow Management

By processing invoices faster and more accurately, businesses gain clearer visibility into liabilities and can forecast cash flow with greater confidence.

Enhanced Supplier Relationships

Faster, error-free payments build trust with suppliers, reduce disputes, and can even unlock early-payment discounts.

Scalability

AI handles spikes in invoice volume effortlessly, whether it’s end-of-month rushes or seasonal peaks.

AI vs. Traditional Automation: What’s the Difference?

You might wonder, “We already use automation. Why bother with AI?” Here’s the difference:

Traditional Automation follows rigid rules. It can only handle structured data and predictable formats. If a vendor changes their invoice template, traditional bots often fail.

AI Automation is flexible. It learns new formats, understands context, and deals with variations in how vendors structure documents. It adapts, rather than breaks, when things change.

In short, AI moves beyond robotic “copy-paste” tasks to true cognitive automation.

How to Get Started with AI in Invoice Matching

Thinking about deploying AI for your invoice process? Here’s how to take the first step:

- Assess Your Pain Points: Identify where manual work and obstacles exist in your current invoice process.

- Choose the Right Vendor: Look for AI solutions specialized in invoice matching with strong integrations for your ERP or accounting software.

- Start Small: Pilot the solution with a specific invoice type or vendor group to measure ROI.

- Train Your Team: Help your finance and AP teams understand how AI tools fit into their workflows.

- Monitor & Optimize: Use analytics from the AI system to continually refine processes and boost performance.

The sooner you begin, the faster you’ll experience savings and efficiency.

Conclusion

AI automation in invoice matching is about managing a more intelligent, leaner, and more resilient company, not just about fancy technology. AI provides a solution to the turmoil caused by manual processes, which cost money, time, and peace of mind. It makes your entire financial operation function like an efficient machine, enhances vendor relationships, and frees up your team to concentrate on strategic tasks.

Are you prepared to move past the tedious manual method and embrace the future of processing invoices? Let’s talk about how artificial intelligence (AI) can transform your company and ultimately put an end to your billing problems.